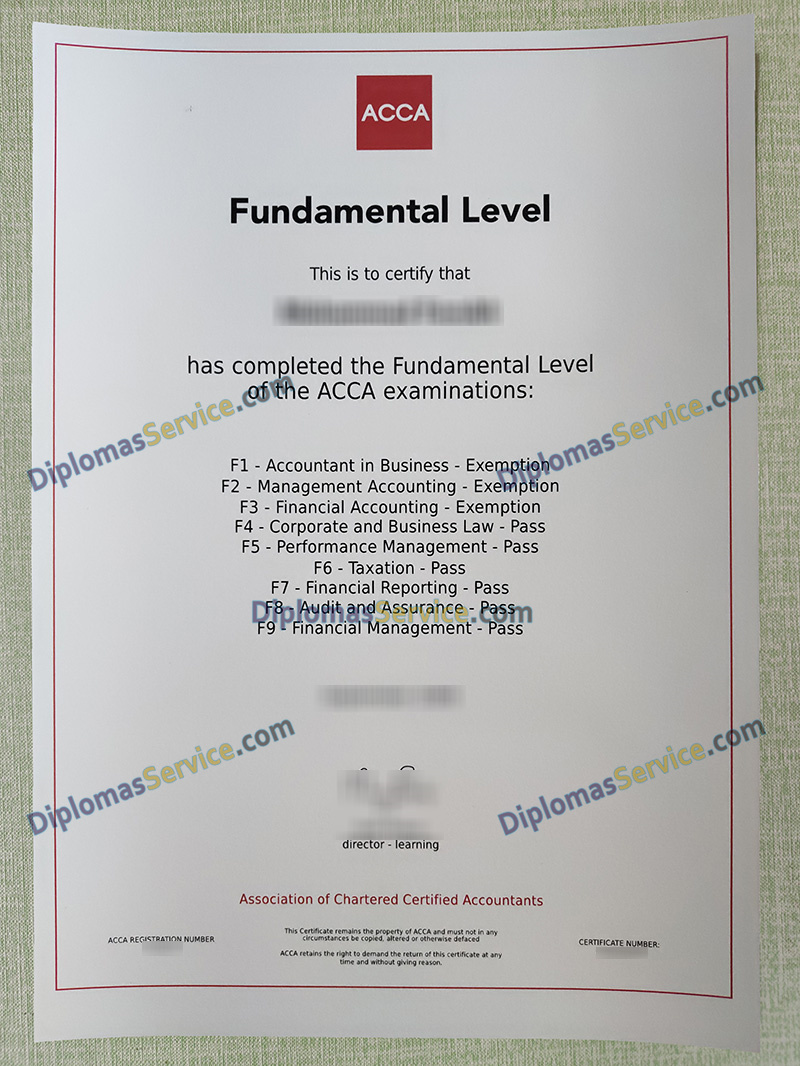

The Association of Chartered Certified Accountants (ACCA) qualification is a globally recognized benchmark for aspiring professionals in accounting, finance, and business. The journey to becoming an ACCA member begins with the Fundamental level, a crucial stepping stone that lays the foundation for future success. The ACCA qualification is structured into three primary levels: Applied Knowledge, Applied Skills, and Strategic Professional, phony ACCA Fundamental level certificate. The Fundamental level encompasses the Applied Knowledge and Applied Skills modules. These modules aim to equip students with a solid understanding of accounting principles, techniques, and their practical applications.

The Breakdown: Papers and Key Concepts

The Fundamental level consists of six papers, each designed to assess a specific area:

- Applied Knowledge: This module focuses on foundational concepts and understanding.

- BT – Business and Technology: Introduces the business environment, information systems, and the role of accounting in business. Key concepts include organizational structure, governance, and information technology.

- FA – Financial Accounting: Covers basic accounting principles, preparation of financial statements, and understanding the regulatory framework. Focus on double-entry bookkeeping, the accounting equation, and financial statement analysis.

- MA – Management Accounting: Explores the role of management accounting in planning, control, and decision-making. Key areas include cost accounting, budgeting, and performance measurement.

- Applied Skills: This module builds on the Applied Knowledge and requires students to apply their understanding to practical scenarios.

- LW – Corporate and Business Law: Introduces the legal system, contract law, corporate law, and other relevant legal principles. Understanding the legal implications of business decisions is crucial.

- PM – Performance Management: Develops the ability to apply management accounting techniques to monitor, control, and improve organizational performance, buy phony certificate. Focus on variance analysis, performance measurement, and strategic performance management.

- TX – Taxation: Covers the principles of taxation, including income tax, corporation tax, and value-added tax (VAT). Understanding tax regulations and their impact on businesses is essential.